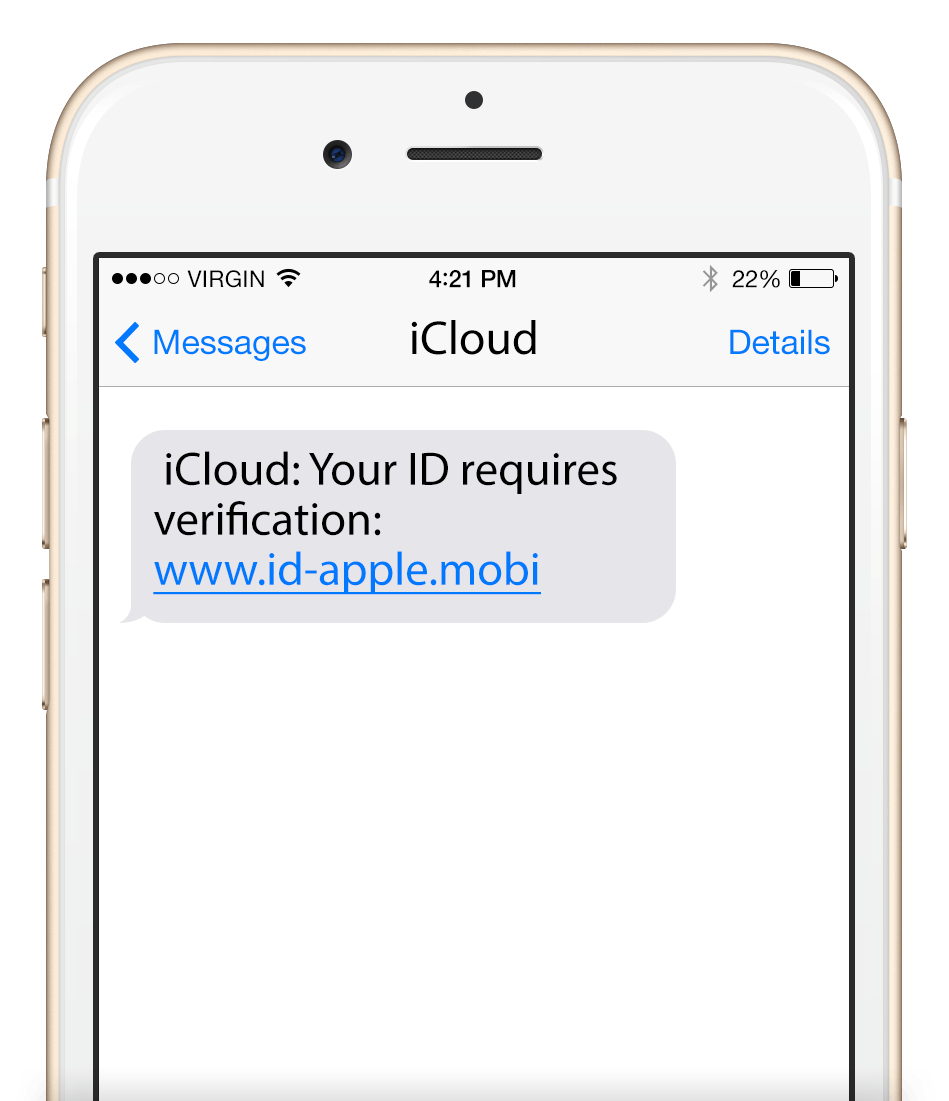

I have been telling people to ensure you know what you are doing, and double check everything before acting upon, so you don’t fall foul of phishing scams.

Back Story

Earlier this week, I was phoned by a call centre claiming to be from the Australian Tax Office (ATO) with a recorded message saying that I had outstanding debts and was also implicated in Tax Fraud, and that there was a warrant out for my arrest. I knew this was a scam, as I have been targeted 4 time before, as well as another family member.

Anyway, I wasn’t going to let this go unanswered, so I rang the number back, and harassed them relentlessly for the next 3 hours until they actually blocked my number.

The Story

Well, I fell victim of a phishing scam. Yes, even the best of us do things without thinking. I naturally didn’t think twice, as I thought it was from the bank and followed through.

The basis of the SMS was that the Commonwealth Bank was testing their SMS and needed me to do some checks, which included me giving them my mobile then a special code. The first clue should have been, they were asking for my mobile number – but it didn’t click. Did what they asked, and didn’t think twice about it. Yep – was busy, and didn’t really think.

Anyway – what I had done was give someone enough information to try and do a card less transaction at an ATM.

What it means:-

- They will need to close the account.

- Create a temporary account.

- I submit a Statutory Declaration saying someone tried accessing my account without my express permission (i.e. phishing scam).

- CommBank open a new account.

- New Cards (possibly).

And any direct debits / scheduled transactions need to be changed. In short, with financial institutions especially, if you get an SMS with a link to a web page to test things, before you do it check with them. They usually have this sorted before going live. Even the best of us, can slip up.